Both are great ways to invest, but results matter!

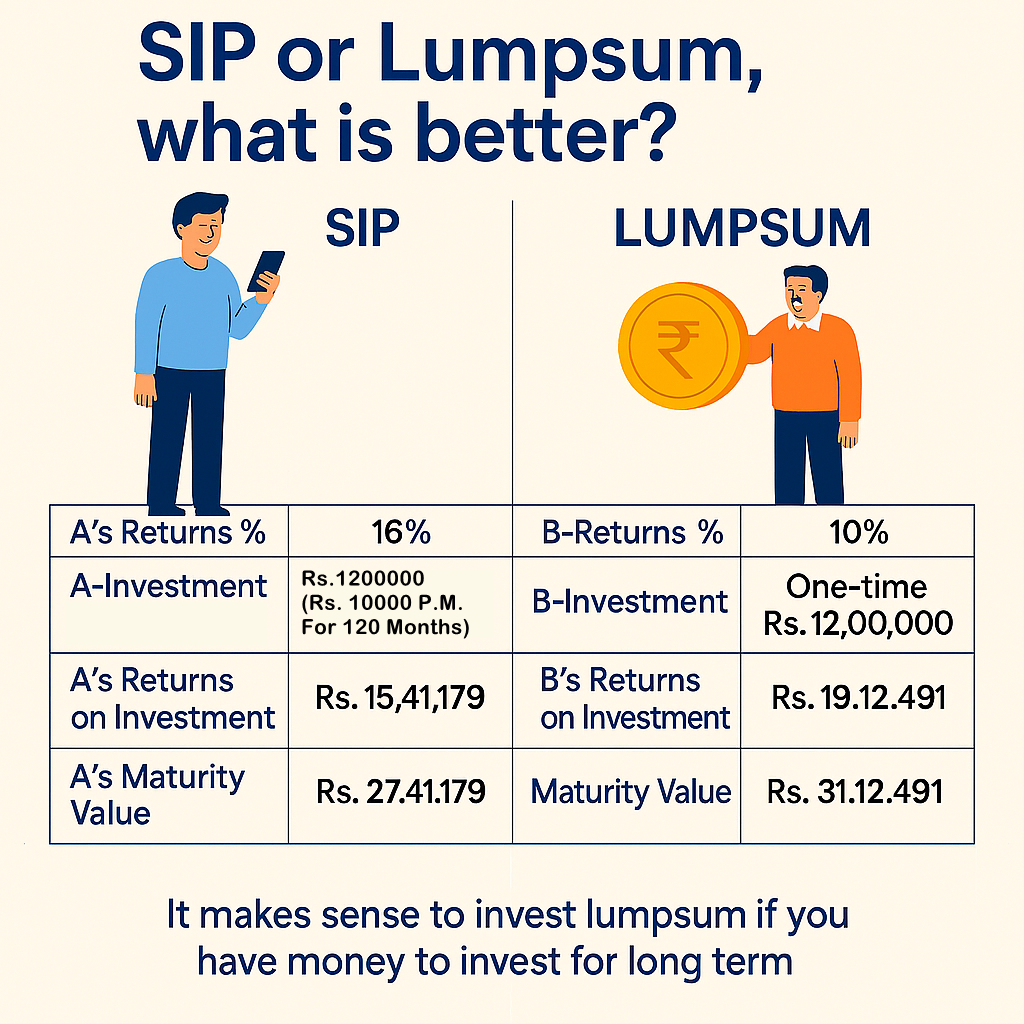

Why Lumpsum Often Outperforms SIP in Absolute Returns

The difference lies in the power of compounding:

Lumpsum investment starts working from day one. The entire amount gets the benefit of compounding for the full investment horizon.

In SIP, each monthly contribution has a different investment duration:

- The first installment compounds for the full 10 years.

- The second for 9 years and 11 months.

- ...

- The last installment has almost no time to grow.

So, the overall return in SIP is roughly the average of all these durations, which is about half the total period.

That’s why, even with a higher XIRR in SIP, the absolute maturity value can be lower than a lumpsum investment.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article